Recently I have been serving clients who started thinking about having a 2nd property to provide monthly income for their retirement. This is a topic close to my heart as my parents worked selflessly all their life to provide for me and my siblings but have never thought about their retirement or themselves.

Currently they are in their 70s and all their asset is in a fully paid home. They do have some savings but not significant enough to provide for anything meaningful. Most government payouts would miss them due to the annual value of their home. Livelihood is dependent on their children’s monthly allowance and CPF LIFE monthly payouts. Thankfully there are the four of us but with family size getting smaller these days and increasing costs, allowances from 1 or 2 is not going to be enough.

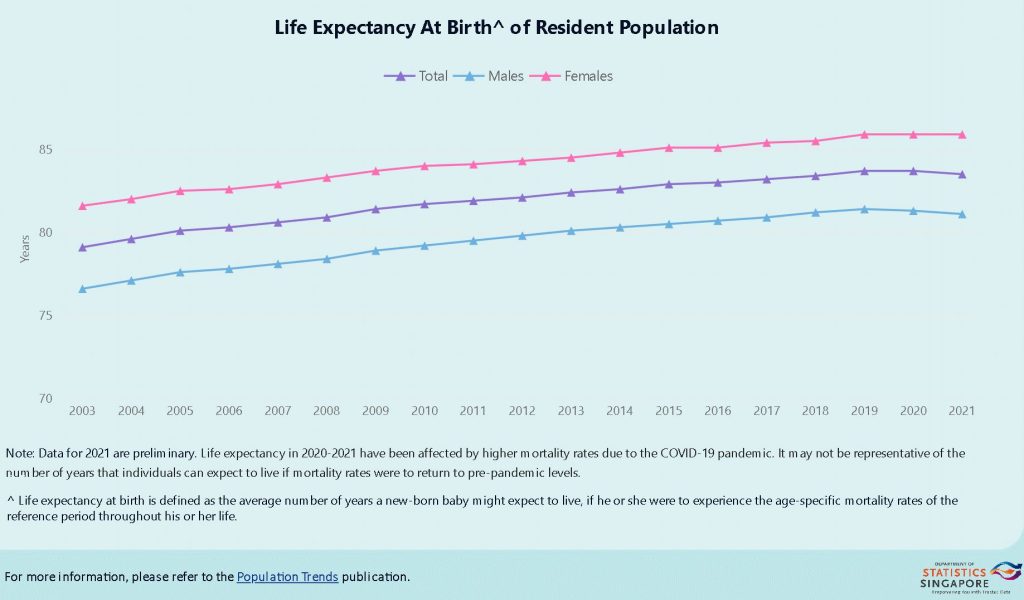

Fortunately or perhaps unfortunately, life expectancy has increased due to medical advancements. Imagine the issues with living to a ripe old age while having a finite pot and depending on your children for livelihood. I will always remember my late grandma whom I loved dearly, wailing that death would come upon her not wanting to be a burden to her kids.

Unfortunately we did not learn financial literacy in school to plan for our future or retirement, relying mostly on the examples of our parents and advices from the insurance industry. We focus on our careers and occasionally relying on the hope of striking 4D/TOTO to achieving financial freedom. Some desire to retire early by avoiding liabilities or take on high risk investments like crypto, both helps having a bigger pot but with record high inflation we must consider how long this pot will last us.

Your home is not an asset

My parents have a fully paid property so they do not have to worry about having a roof over their heads. However this home is not an asset as it does not put money in their pocket, it simply covers their accommodation cost.

Assuming unfortunate events are covered by insurance, they still need to pay for utilities, living expenses and their retirement activities. These are liabilities that take money from their pockets every month. If they had a perpetual income stream to cover the monthly liabilities, they would have greater freedom.

Inflation

Let’s assume a $2,000 monthly liability and a fixed deposit that pays a perpetual 2%pa. This is honestly an optimistic assumption as we saw in the last several years where rates were far under 1%pa. You would need $1.2m in cash to give you $24,000 a year or $2,000 a month.

According to the latest available data based on the year 2021, median gross monthly income from work (including employer CPF contributions) of full-time employed residents is $4,680. Assuming you save $2,000 a month with a 2% annually compounding interest, you would need to save for 35 years to accumulate $1.2m.

This sounds fine until we factor in the average inflation rate in Singapore for the last 30 years at 1.5%, you would need to save for 45 years to accumulate a future value of $1.2m. 65 years old retirement age minus 45 years is 20 years old, we have not even graduated from university yet!

here is one solution - owning a 2nd property

Primary purpose of a property is to provide a roof over our heads so a 2nd one would be to provide a roof over our tenants head. With low birth rates, Singapore has committed to attracting foreign talents to boast the only resource we have, manpower. These would be your target tenants who would not immediately purchase a home for a new job relocation. Most likely case is after several years when they obtain permanent residency (PR) as ABSD drops from 30% to 5%.

A $800k property would require $221k to purchase with income to support a loan of $600k. Depending on your age, the rental would cover the monthly installment for the loan. This means that at the end of the loan tenure, you have basically bought a $800k condo for $221k. On top of that, you can continue to receive rental throughout the length of the lease which is likely your whole life and more.

The market average rent is 3% of the property price which is $2,000 per month for a $800k condo.

retirement home

As we come close to retirement, our children may have gotten married and moved out. Leaving the bedrooms empty, it becomes a chore for the elderly couple to maintain. Buying a smaller property at this time would cost much more than it was 20 years ago. This 2nd property is therefore bought in advance for your retirement but renting out at the moment since you do no need it.

With a 2nd home you can stay in the smaller property and rent out the larger one for a higher rent. You may also cash out by selling one of the property to fuel your dreams or finance your children’s education.

With property wealth planning, you would be sitting on $3.2m of assets with a source of passive income. Let us summarize certain techniques used here;

- Plan early for retirement

- Have a passive and constant income stream that will last us for life

- Protect your assets from inflation by holding inflation hedged assets

- Using leverage on assets that generate income that pays for itself

- Purchase a retirement home early at lower prices