New launch condominiums are some of the most expensive condos you can find on the market. They are also called Building Under Construction (BUC) which leave some fearful of purchasing based on floor plans and a show flat with heavy interior design (ID) treatment. While it is uncommon for developers to go bust, those who have real estate experience overseas would be aware of the risk. The biggest challenge is the wait time of 3 to 4 years. Higher prices and long waiting time, what is the attraction and who is it suitable for.

Higher price per square foot

Here are 5 reasons why

- New condominiums comes with a fresh lease of 99 years, just as a brand new car is more expensive then a 2nd hand car with less years on the COE.

- Everything in the home is new and comes with wardrobe, hood, hob, oven, washing machine. fridge, water heater and air con in your purchase price. This greatly reduces renovation costs, especially in today’s high cost climate.

- A more efficient layout that better suits modern living. Planters and bay windows are classic examples that do not contribute much to the effective living space. Rooms used to be larger but the modern lifestyle prefers a larger kitchen, living and dining for hosting guests. Decent size balcony for BBQ or alfresco dining is highly sought after with the invention of Ziptrack blinds.

- Finishing, materials and manufacturing methods have advanced over the years, with more emphasis on sustainability to increase energy efficiency and lower maintenance costs.

- Technological progress have lowered costs of smart home features. Automated systems including voice activation, remote control, wireless camera monitoring and smart door lock have become standard features in today’s condominium.

PSF vs quantum

| Type | Queens TOP 2002 | Stirling Residences TOP 2022 |

|---|---|---|

| 2 Bedrooms | 915 sqft $1.27m | 624-764 sqft $1.3m-$1.68m |

| 3 Bedrooms | 1184-1195 sqft $1.51m-$1.53 | 883-1055 sqft $1.9m-$2.26m |

| 4 Bedrooms | 1410-2390 sqft $1.85m-$2.30m | 1345 sqft $3m |

Developers are sensitive to what neighboring projects are offering and their market prices. Queens and Stirling Residences are located next to each other beside Queenstown MRT. Although they are 20 years apart, the prices for their 2 and 3 bedrooms unit are not very far apart.

| Hawaii Tower TOP 1984 | Meyer Mansion TOP 2024 |

|

|---|---|---|

| 3 Bedrooms | 2239 sqft $3.74m | 1109-1722 sqft $2.8m-$4.5m |

Meyer Mansion is a new launch that is averaging $2,680psf. The older Hawaii Tower next door has a median price of $1,670psf but at 2239 sqft for it’s 3 bedrooms, it brings the total price to $3.74m. As a lower income is required to purchase Meyer Mansion, it outperforms Hawaii Towers.

While new launches are more expensive per square foot, the overall price could be lower than neighboring units because they are smaller. The quantum is therefore more important due to TDSR criteria in terms of affordability as compared to simply looking at psf prices.

price trend comparison

We have done many comparisons of new launch vs resale condominium which give the same results. The graph above plots all the transactions for New Sale and Resale for the past 10 years. New Sale prices have increased 81% compared to 17% for Resale. The high growth rate of new launches are partly due to the developer’s pricing strategy which will be explained in the next point.

In terms of rental, new condominiums are able to demand higher rentals. As a property age, rental returns start to fall as tenants favor newer properties with more facilities. This is more obvious after 10-15 years which will affect what investors are willing to pay for the declining rent.

lower entry price

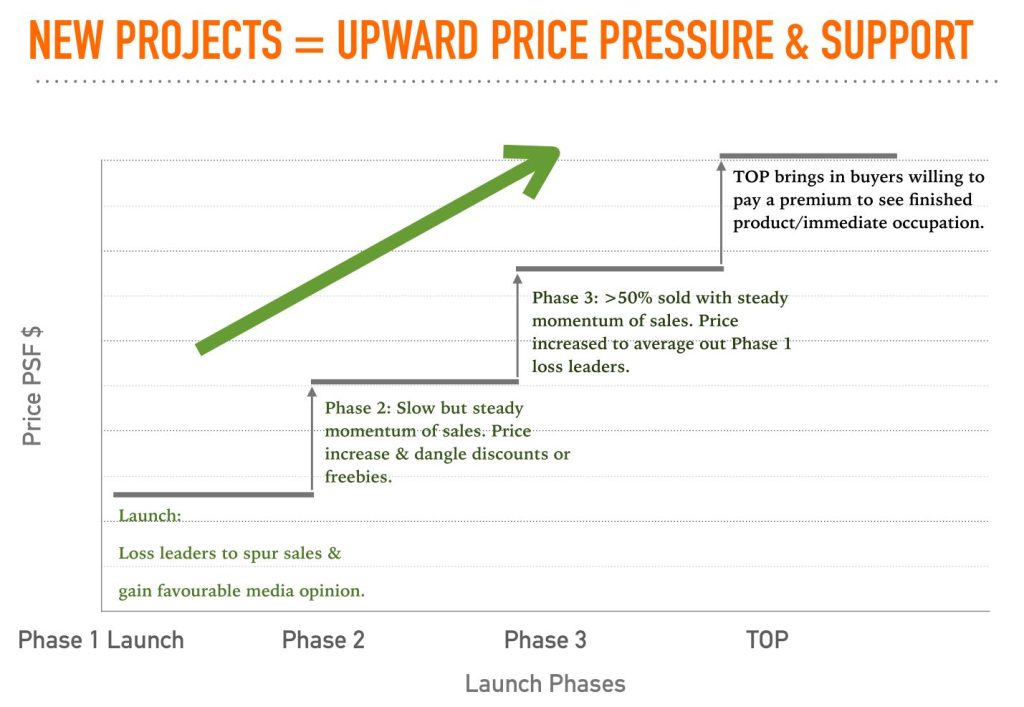

Developers commonly start selling at an attractive price to gain favorable media coverage. Internally they require at least 30% of the units being sold to obtain financing for their construction. Early adopters are therefore rewarded with lowest prices (aka early bird prices) due to the pricing strategy of the developer. This strategy creates a win-win scenario for both the buyer and the developer, forming a trend to entice future projects and buyers.

Entering at a lower price not only gives you the highest profit, more importantly it lowers your risk when you decide to exit as you are able to sell at prices lower than those who bought later and at a higher price.

For the big new launches this year, we have seen developer increase prices several times during VIP booking day of up to 5% due to the high demand and take up rate. The price increase is related to both market movements and the percentage of units sold. With few remaining units and several years to TOP, developers have little urgency to sell out the project, turning their focus to maximizing profits at the later stage with higher prices.

Income tax and costs

In property investment, profits come from capital appreciation and rental income. While capital appreciation is arguably speculative, rental income is more or less guaranteed depending on the asking rent. However, capital gains are non-taxable while rental income is subjected to personal income tax.

While it is nice to receive rent monthly in cash, there are other related costs we need to consider. They include;

- Monthly maintenance fee paid to MCST

- Maintenance of home contents and renovations due to fair wear and tear

- Home insurance of home contents

- Property Tax at non-owner occupied rates (10% of annual value)

- Personal income tax depending on tax bracket

- Cost of securing tenant (Agent fee is 1 mth rental for a 2 years lease)

The above costs are not applicable for a building under construction, so my recommendation is for working individuals to focus on capital gains while retirees focus on rental income. New launch purchasers may be losing out on rent but would be avoiding these costs while riding on high price growth. A 10% growth over 3 years is more than the market average of 3%pa rental rate.

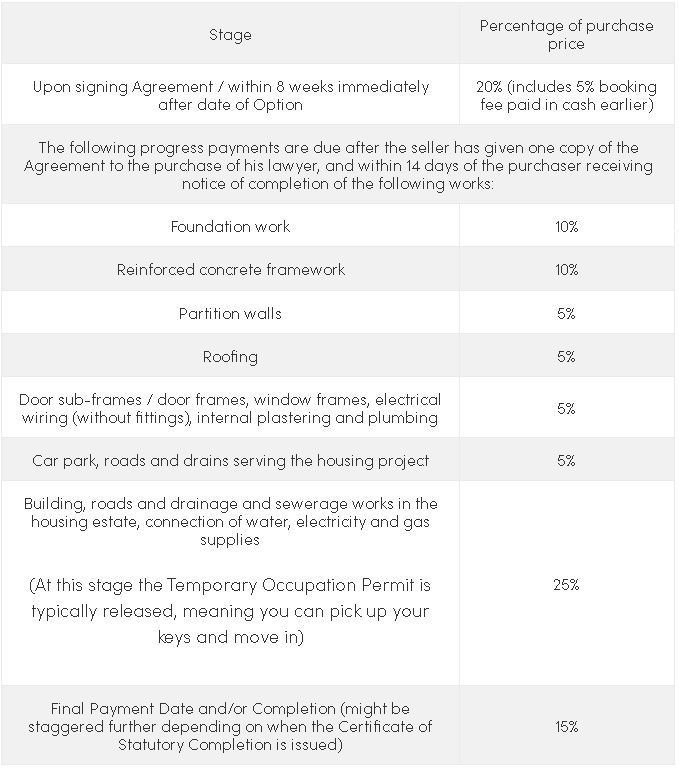

progressive payment

Developers typically follow the progressive payment scheme set out by the Housing Developers Rules. Payment is collected when a certain construction milestone has been reached. Cash and CPF has to be used first before bank loan is being disbursed.

If you are taking a 75% loan, the first bank disbursement can be 1 year after the launch. This is a very small amount as only 5% would be disbursed at foundation. In a high interest rate environment, this delay in payment can help us reduce the exposure of high rates until interest rates fall back in the next 1 – 2 years.

Investors who are focusing on capital appreciation might sell once they cross the 3 years Seller Stamp Duty (SSD) period or at TOP. The progressive payment scheme in this case would greatly increases the Returns on Equity (ROE).

| Amount | |

|---|---|

| Property Price | $1,000,000 |

| Appreciation in 3 years 10% of property price | $100,000 |

| Down payment 25% + costs + installments (estimate) | $300,000 |

| Return on Equity (Appreciation/Downpayment) | 33% |

Progressive payment scheme is great for those who do not need a place immediately or have funds coming in only later. For example, someone who is looking to downsize at retirement can buy a new launch that will TOP at retirement and make staggered payments until the condominium is completed.

You can also purchase a new launch that completes at retirement to optimize income tax from earned income to rental income.

In a research done, out of 115,610 new homes sold by developers in the last 10 years. 9 out of 10 who resold profited with majority in the OCR region.

Feel free to contact me to check if you are suitable to invest in a new launch